How Credit Ratings Became Essential Signals of Trustworthiness: New Archival Evidence

Bruce Carruthers is the John D. MacArthur Chair and

Professor of Sociology

and Director of the Buffett Institute for Global Studies at Northwestern University. He has been spending the summer doing archival research at the Library of Congress in Washington, D.C., and he shared this update on his findings.

Bruce Carruthers is the John D. MacArthur Chair and

Professor of Sociology

and Director of the Buffett Institute for Global Studies at Northwestern University. He has been spending the summer doing archival research at the Library of Congress in Washington, D.C., and he shared this update on his findings.

In my conceptualization, when person A trusts person B to do X, it means that A proceeds with the expectation that B will do X. Trust involves vulnerability and uncertainty, in the sense that B’s actions affect A, but A doesn’t know what B is going to do.

This conceptualization works very well for the topic I am interested in, namely credit (a mainstay of the modern economy). Creditors trust debtors to repay the money they borrow. Creditors are uncertain about whether the debtor will repay, and are vulnerable depending on the size of the loan. Creditors deal with this problem by gathering information about the debtor, to reduce uncertainty, or by reducing their vulnerability. I am especially interested in how creditors gather information about the trustworthiness of would-be borrowers, and in new types and sources of information. One in particular has been important in US economic history: credit ratings.

Early Credit Rating and Reporting

The Mercantile Agency was founded in 1841 by Lewis Tappan, and provided information about creditworthiness of customers to New York City suppliers. Information came came from a network of correspondents and branch offices, and was sold to subscribers as credit reports and ratings.

This agency, later known as R.G. Dun, grew to the point where it was rating more than a million firms, nationally and internationally. And use of agency ratings became part of standard business practice by the end of the nineteenth century.

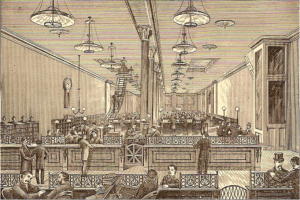

R.G. Dun’s head office, New York City 1883

R.G. Dun’s head office, New York City 1883

In its proprietary ledgers, the agency recorded information about individual firms. For example, in October of 1873 it noted that Nathan Tiffany’s dry goods firm, based in Chicago, had assets worth around $1800, and liabilities worth around $300. It also noted that he had a reputation for honesty, paid his bills promptly, and that his wife owned real estate worth $1500. But this kind of information is not what the firm sold to its subscribers. Instead, it provided them with compendious reference books in which they could look up the rating of Tiffany’s firm, and many thousands of others.

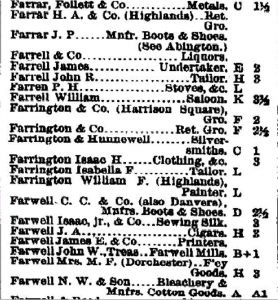

Reference books

Reference books were issued for individual cities, or regions of the country, and listed the rated firms alphabetically, by the last name of the proprietor, including information about the line of business. It also contained the firm’s credit rating.

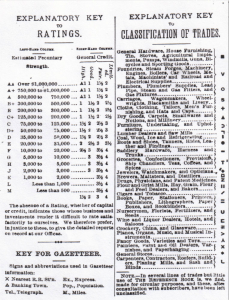

A key at the front of the reference book explained the rating system. R.G. Dun used two dimensional ratings, and assessed firms in terms of their “pecuniary strength” and their “general credit.” Higher ratings meant that, in the judgment of the agency, the firm was more likely to pay its debts. It was more trustworthy. But behind the scenes, there was no systematic method, coding scheme or algorithm to produce the rating. Nevertheless, the rating business succeeded.

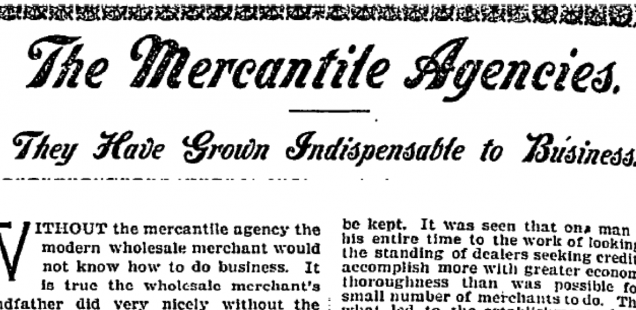

As the Chicago Tribune (March 15, 1896) put it, mercantile ratings had become “indispensable.”